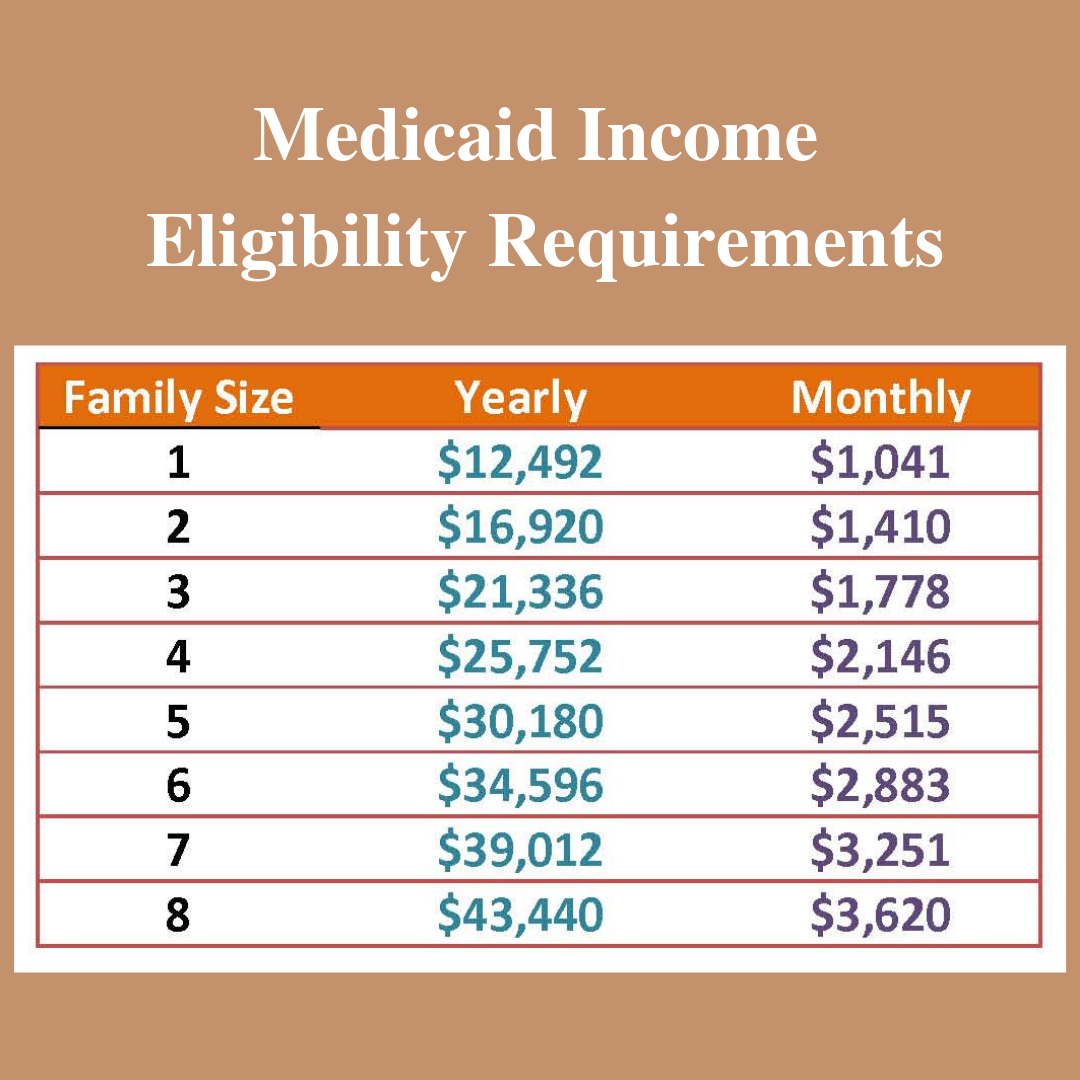

Non Magi Medi-Cal Income Limits 2025. $375 x 4.33 = $1,623.75 gross income; $30 x 4.33 = $129.90 dependent care.

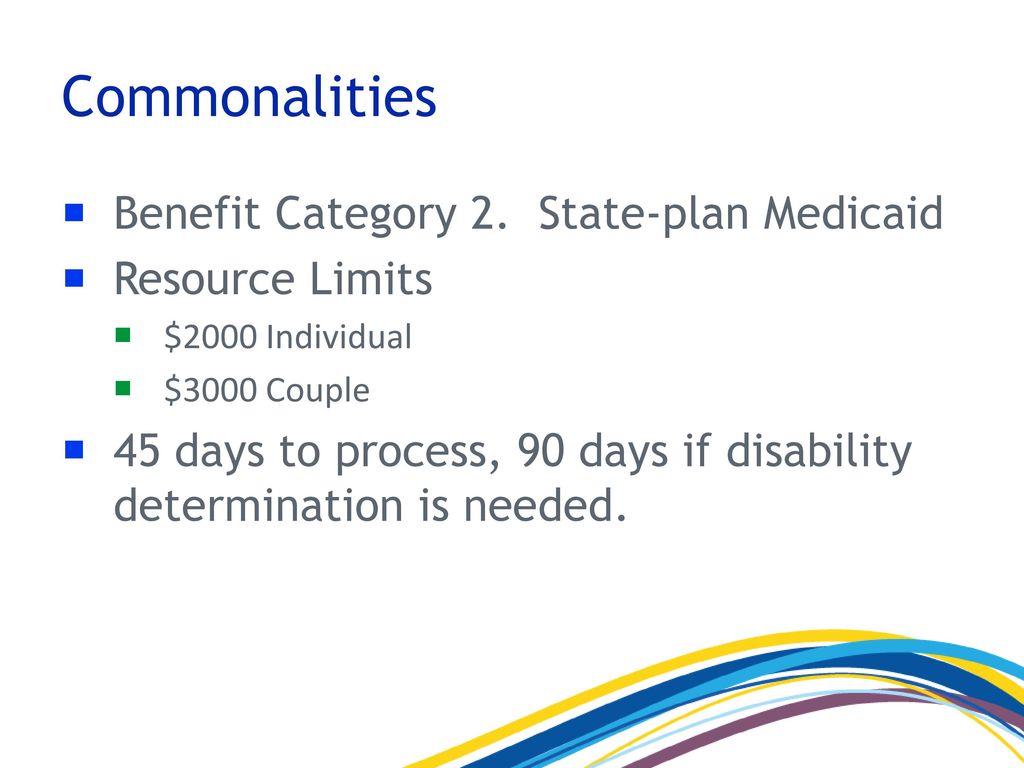

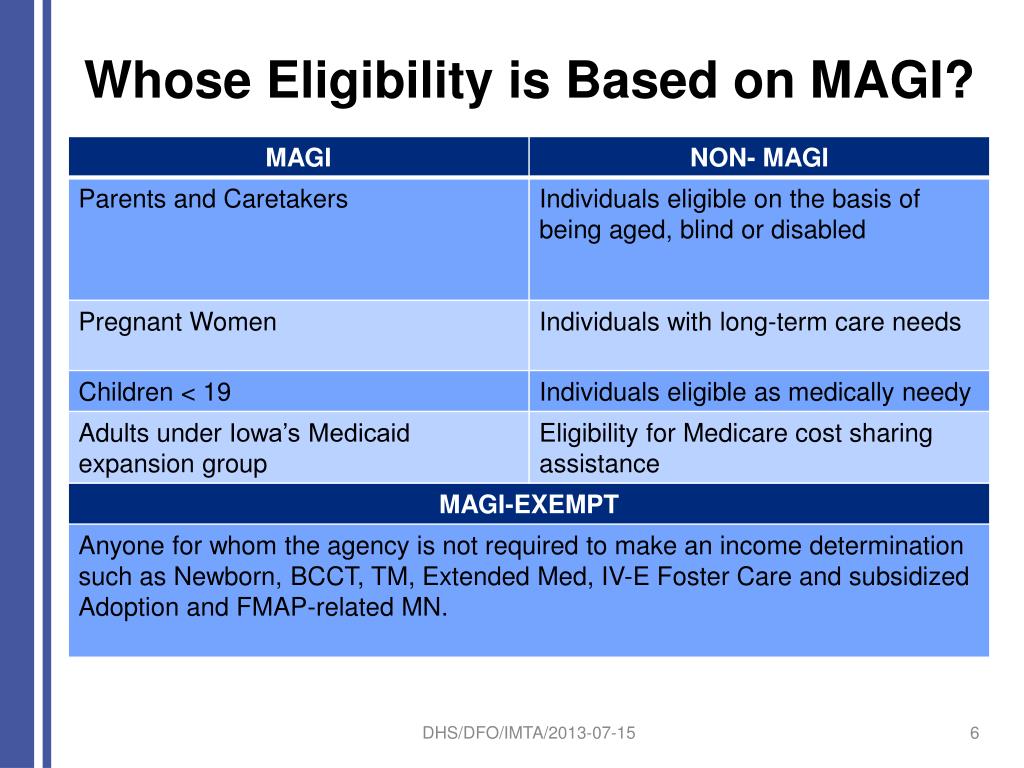

PPT Medical Assistance 101 PowerPoint Presentation, free download, Dependent care deductions are limited to maximum allowable amounts (i.e. The increased asset limit has nothing to do with.

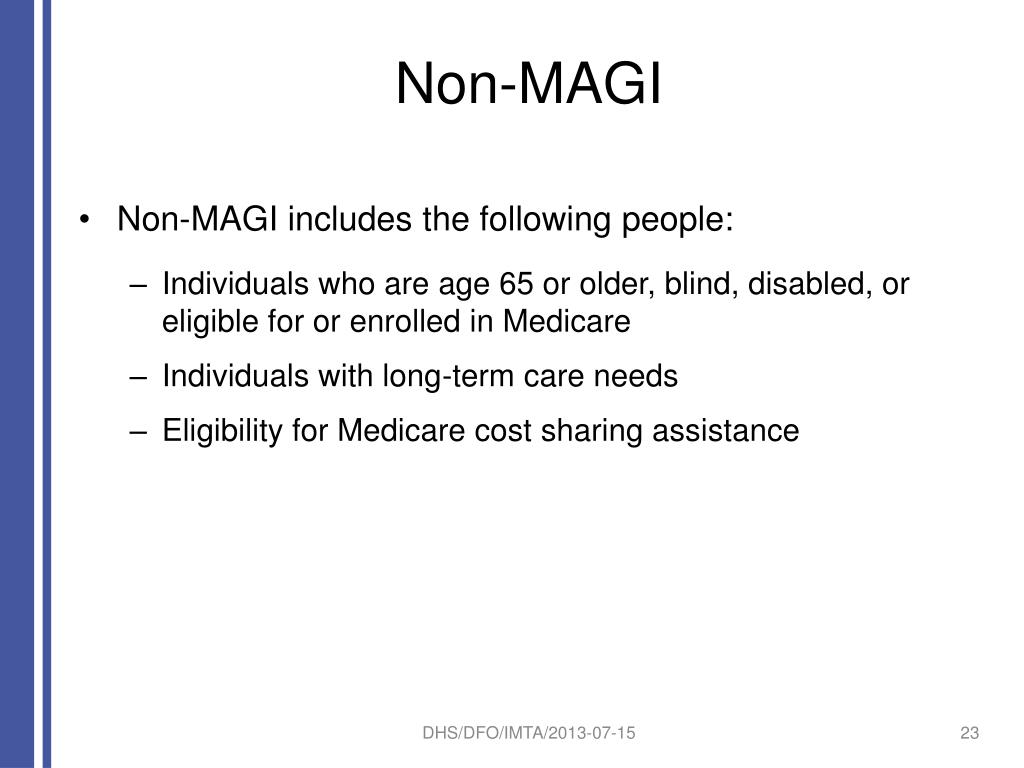

PPT Medicaid 201 PowerPoint Presentation, free download ID6158189, The covered california income limits require consumers to have a household income that ranges from 0% to 400% of the federal poverty level (fpl) in order to qualify for. The increased asset limit has nothing to do with.

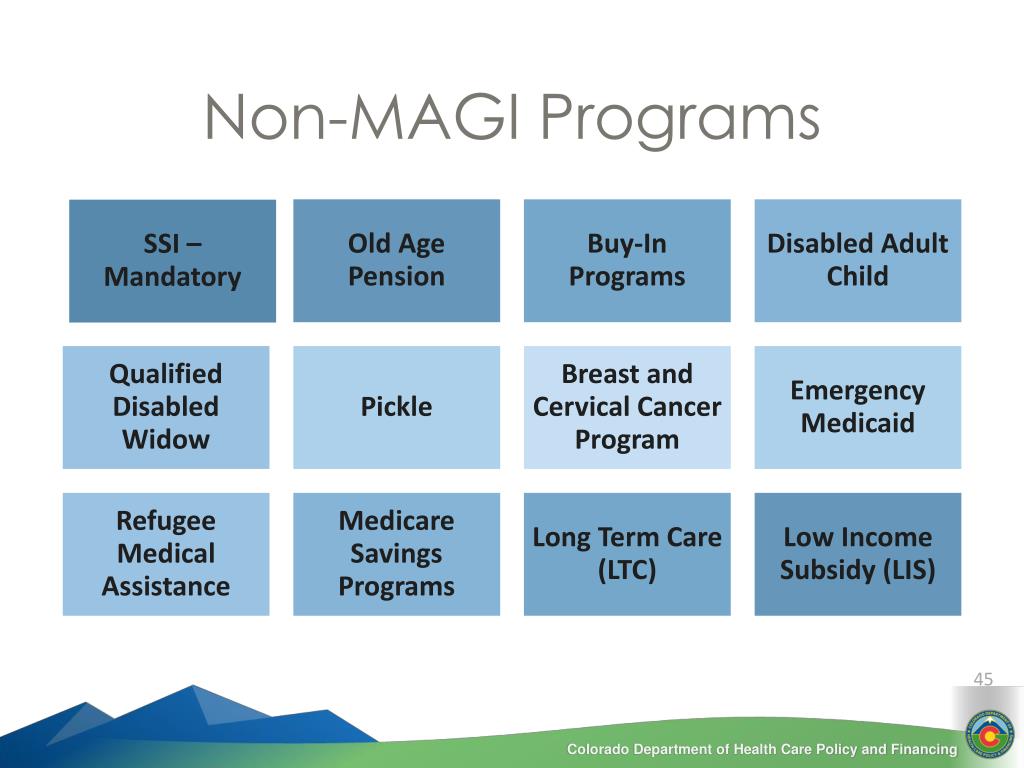

Expanding Foundations NonMAGI ppt download, $375 x 4.33 = $1,623.75 gross income; Dependent care deductions are limited to maximum allowable amounts (i.e.

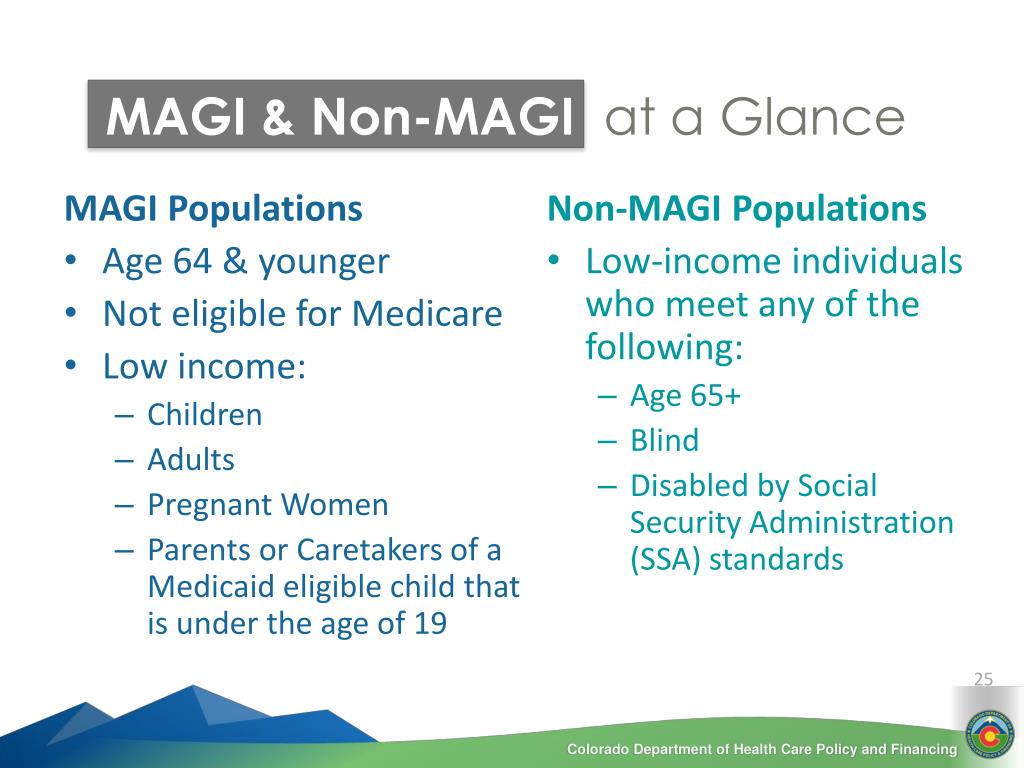

PPT Affordable Care Act MAGI and nonMAGI PowerPoint Presentation, $375 x 4.33 = $1,623.75 gross income; The increased asset limit has nothing to do with.

Magi MediCal Limits 2025 Ines Tallie, The covered california income limits require consumers to have a household income that ranges from 0% to 400% of the federal poverty level (fpl) in order to qualify for. These deductions are applied only if a.

PPT Affordable Care Act MAGI and nonMAGI PowerPoint Presentation, Asset verification program (avp) reporting. This change impacts many areas of determining eligibility, creating a layer of.

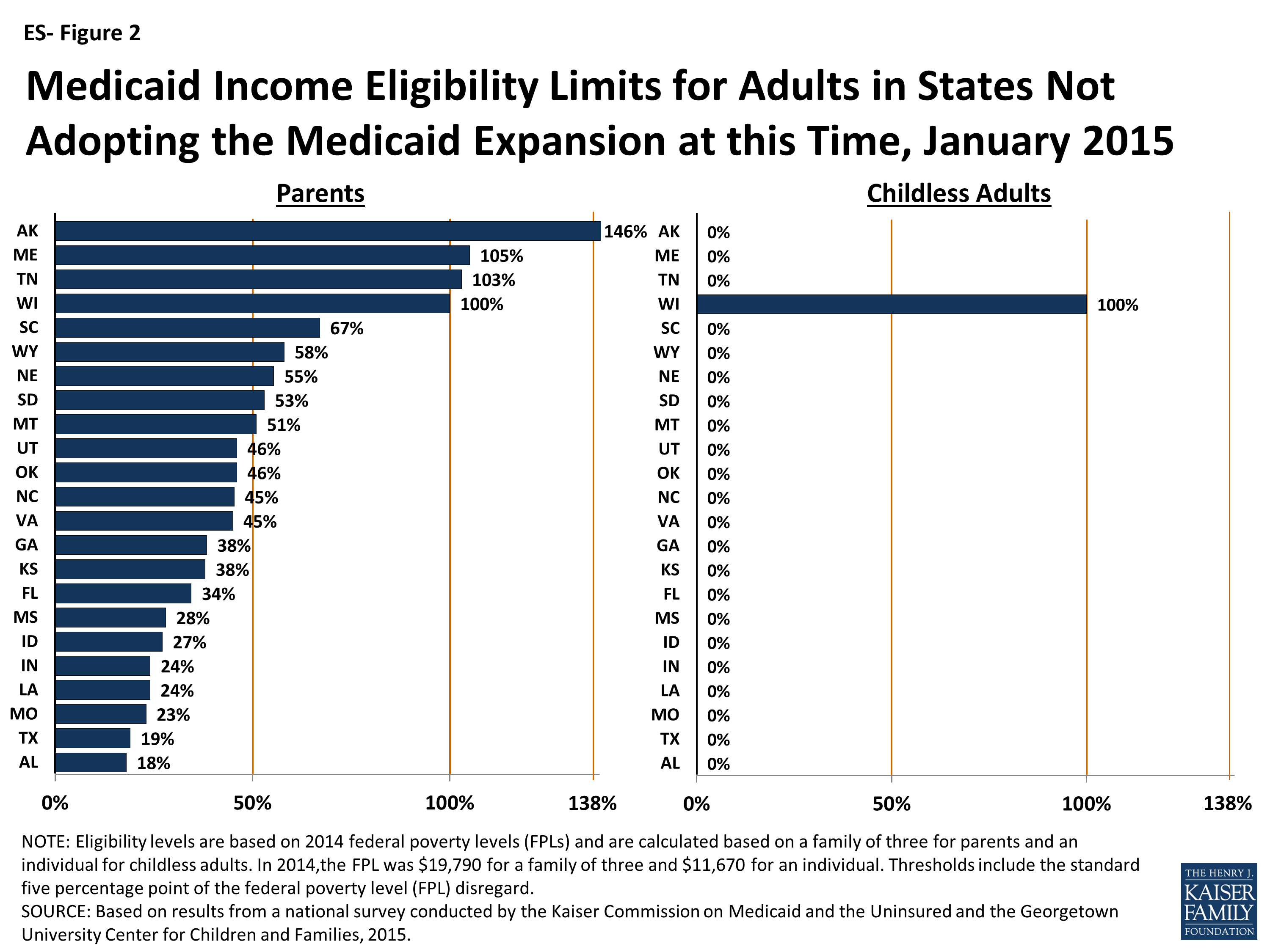

Medicaid Limits By State 2025 Elysia Atlante, The increased asset limit has nothing to do with. Dependent care deductions are limited to maximum allowable amounts (i.e.

MediCal Limits 2025 Family Of 3 Andy Maegan, $30 x 4.33 = $129.90 dependent care. The covered california income limits require consumers to have a household income that ranges from 0% to 400% of the federal poverty level (fpl) in order to qualify for.

Expanding Foundations NonMAGI ppt download, $30 x 4.33 = $129.90 dependent care. Asset verification program (avp) reporting.

2025 MAGI Medi Cal Limits YouTube, $375 x 4.33 = $1,623.75 gross income; Dependent care deductions are limited to maximum allowable amounts (i.e.

+Income+Disregards.jpg)