529 Plan 2025 Changes. The secure act 2.0 is bringing many changes,. 529 education plan changes in 2025:

New fafsa launches after a long delay — but with some ‘issues,’ ed dept. Tax law that should strengthen americans’ ability to save more money for.

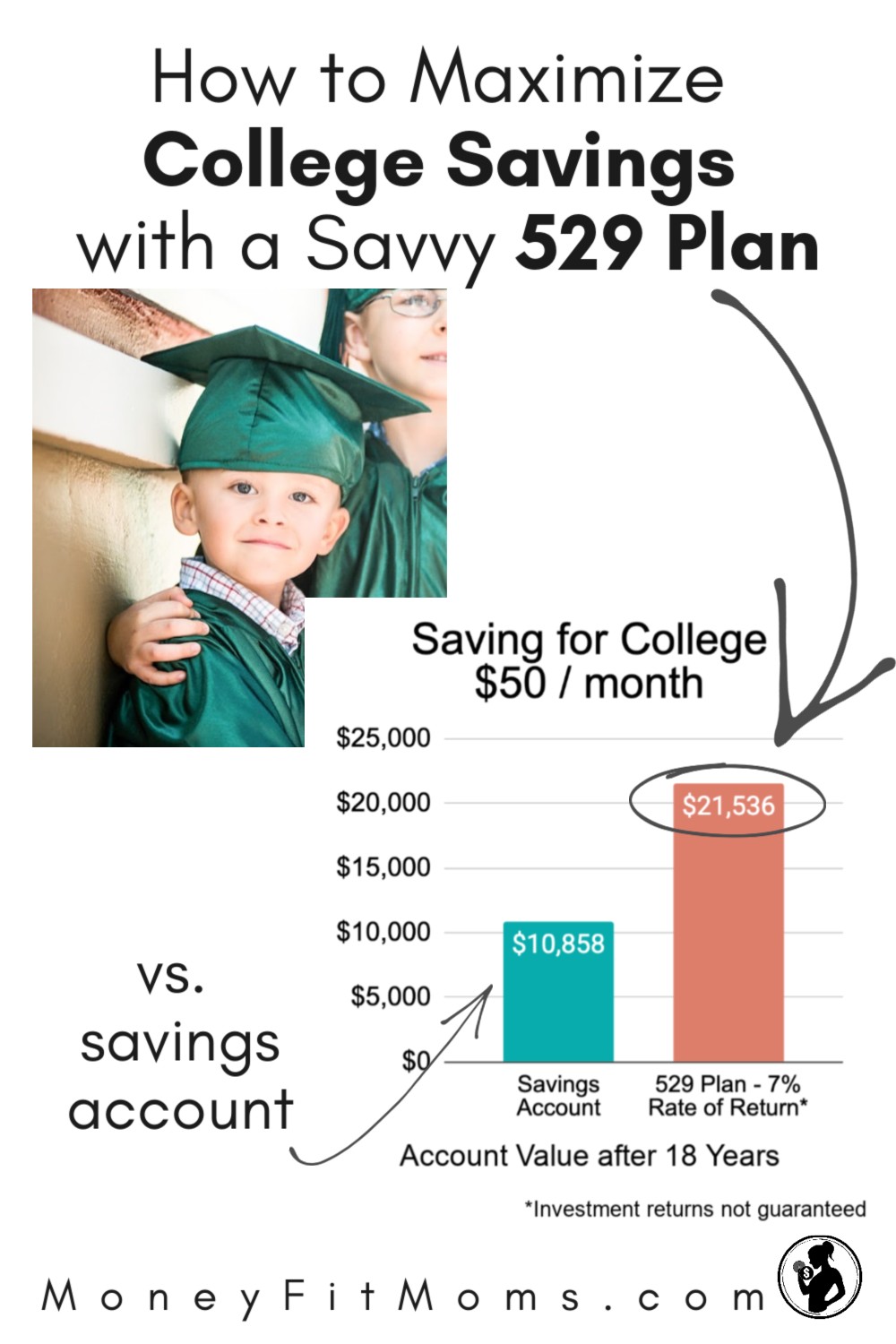

How to Maximize College Savings with a Savvy 529 Plan, Currently, a 529 plan withdrawal for anything other than qualified education expenses may be subject to income tax and a 10% penalty. The secure 2.0 act, passed by congress at the end of 2025, introduced several changes to u.s.

What is a 529 Savings Plan? Community 1st Credit Union, Now they can do even more. A $1.7 trillion government funding package has a provision that lets savers roll money from 529 plans to roth individual retirement accounts free of income tax or tax penalties.

May 29 is 529 Plan Day Access Wealth, Specifically, this piece of legislation makes it possible for families to rollover up to $35,000 from a 529 plan to an ira, although these changes don't become permanent until 2025. 529 contribution limits for 2025:

CollegeBound 529 plan changes Invesco US, Among these changes is a groundbreaking provision that will debut in. There are two plans that currently have our highest medalist rating of gold.

How to Use a 529 Plan to Finance Your Kid's College Costs Rebalance, In 2025, if your 529 has been open for at least 15 years you will be. New fafsa launches after a long delay — but with some 'issues,' ed dept.

Smart College Plan for Kids529 Vs 7702 7702 for college Savings, Taking rmds from traditional or roth 401(k)s, 403(b)s, 457(b)s or iras. How it affects 529 plans.

529 College Savings Plan Unused White Oaks Wealth Advisors, 529 education plan changes in 2025: “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial planning made.

GA 529 Plan Changes Wiser Wealth Management, Law provides more flexibility for 529 plan assets. The secure 2.0 act, which congress passed at the end of 2025, made a host of changes to u.s.

529 Plan Contribution Limits Rise In 2025 YouTube, 529 contribution limits for 2025: There is no federal tax advantage for the contributions, but some states.

What's better? A Custodial account or a 529 plan? Blue Haven Capital, 529 plan contribution limits in 2025. On march 13, 2025, my529 published a supplement to the february 15, 2025, program description.